Decoding Negative Gearing: The Growth Play

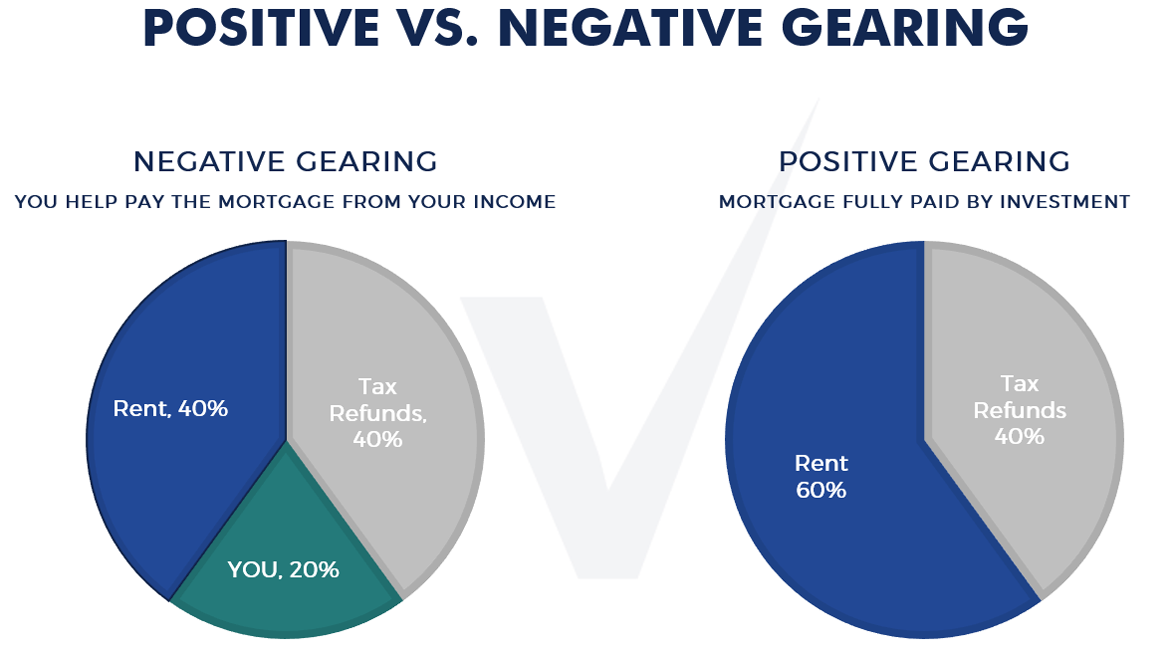

A property is negatively geared when its total expenses (including loan interest, rates, and maintenance) exceed the rental income it generates.

You've probably heard the enticing offers: "Own this investment property for just $100 per week!" While appealing, this means you'd be personally contributing $5,200 per year out of pocket for the privilege of ownership.

At first glance, this might seem counter-intuitive: "Aren't investments supposed to make money?" The answer lies in the strategy. In rapidly appreciating markets, such as Sydney experienced around April 2021, investors might willingly accept a small annual cash loss ($5,200 in our example) because the property's value is skyrocketing by $50,000, $100,000, or even more per year.

Negative gearing is a calculated strategy best suited for specific market conditions – typically booming capital growth cycles, combined with the right interest rates, deposit structure, and overall investment plan. However, be mindful: a portfolio heavily reliant on negative gearing can reduce your overall borrowing capacity for future acquisitions.

Embracing Positive Gearing: The Cash Flow Champion

So, what about positive gearing? This is when your property's rental income exceeds all its expenses, including loan interest.

The result? The property effectively pays for itself, and then some! A cash flow-positive property offers immense peace of mind. You don't need to contribute anything to its running costs; instead, it generates surplus income. This minimises your financial burden and provides a welcome boost to your cash flow, helping you sleep soundly at night.

The Key Takeaway: Your Strategy, Your Goals

Should you aim for negative or positive gearing? There's no single "right" answer. Your optimal gearing strategy will depend entirely on your individual financial needs, long-term wealth goals, and your personal risk tolerance.

Are you chasing aggressive capital growth in a booming market and comfortable with some out-of-pocket expenses? Negative gearing might align. Are you prioritising stable cash flow, reduced financial pressure, and a self-sufficient investment? Positive gearing could be your ideal path.

Let's discuss which gearing strategy best aligns with your unique investment vision and helps you achieve your property aspirations.